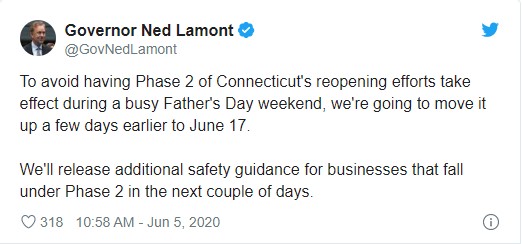

Connecticut Phase 2 moved up by 3 days to June 17

Governor Lamont and Banking Commissioner Perez announce 60-day extension to mortgage relief program

Governor Lamont and Banking Commissioner Jorge Perez today announced that over 45 banks and credit unions have agreed to extend their voluntary participation in the Connecticut Mortgage Relief Program, which provides relief to consumers facing financial hardship due to COVID-19. The program, launched on March 31, 2020 and set to expire on May 31, 2020 will now run through July 30, 2020.

“While the state continues its progress towards safely re-opening, Connecticut residents continue to be impacted by the economic fallout of the pandemic,” Governor Lamont said. “By extending the Connecticut mortgage relief program through July 30, 2020, credit unions and banks have demonstrated their commitment to help their members and customers through this crisis. I am grateful for their participation in this program.”

The program, launched on March 31, 2020, extends the following original provisions through July 30, 2020:

- 90-day grace period for all mortgage payments: Participating financial institutions will continue to offer mortgage-payment forbearances of up to 90 days, which will allow homeowners to reduce or delay monthly mortgage payments. In addition, the institutions will continue to:

- Provide a streamlined process for requesting forbearance for COVID-19-related reasons, supported with available documentation;

- Confirm approval and terms of forbearance program; and

- Provide the opportunity to extend forbearance agreements if faced with continued hardship resulting from COVID-19.

- Relief from fees and charges: Through July 30, 2020, participating financial institutions will waive or refund mortgage-related late fees and other fees including early CD withdrawals.

- No new foreclosures for 60 days (through July 30, 2020): Financial institutions will not start any foreclosure sales or evictions.

- No credit score changes for accessing relief: Financial institutions will not report derogatory information (e.g., late payments) to credit reporting agencies but may report a forbearance, which typically does not alone negatively affect a credit score.

For the full release click here.